Private insurance is a tool that protects us from risks that we may face in our daily lives in various aspects of our economic and social activity.

The value of a private insurance is activated and proves its potential in difficult times, acting as a safety cushion, so that we are never exposed:

- If our home is damaged by severe weather events

- If our business operations are abruptly interrupted due to fire

- If an unexpected health problem upsets the balance in our lives and we need to fight our battle

This is the value that private insurance offers.

ΦυσικΕς Καταστροφές

Τις τελευταίες δεκαετίες και ειδικότερα τα τελευταία χρόνια στην Ελλάδα έχουμε βιώσει αρκετά ακραία φυσικά φαινόμενα, τα οποία οδήγησαν σε μεγάλες οικονομικές απώλειες. Κατοικίες, επιχειρήσεις, καλλιέργειες και κτηνοτροφικές μονάδες καταστράφηκαν από πλημμύρες, πυρκαγιές και σεισμούς. Οι ανασφάλιστες περιουσίες παρέμειναν στο έλεος των φυσικών καταστροφών. Οι περιουσίες που ήταν ασφαλισμένες αποζημιώθηκαν, τα κτίσματα ξαναχτίστηκαν, οι επιχειρήσεις ξαναστήθηκαν.

Χαρακτηριστικό παράδειγμα η Κρήτη και ο νομός Λασιθίου. Από τα ακραία καιρικά φαινόμενα στην Κρήτη στις 15 Οκτωβρίου 2022, δηλώθηκαν 135 ζημίες αποζημιωτικής αξίας 4.965.857 €. Από τις 135 ζημιές, οι 70 δηλώθηκαν στο νομό Λασιθίου με αποζημιωτική αξία 2.450.913 €.

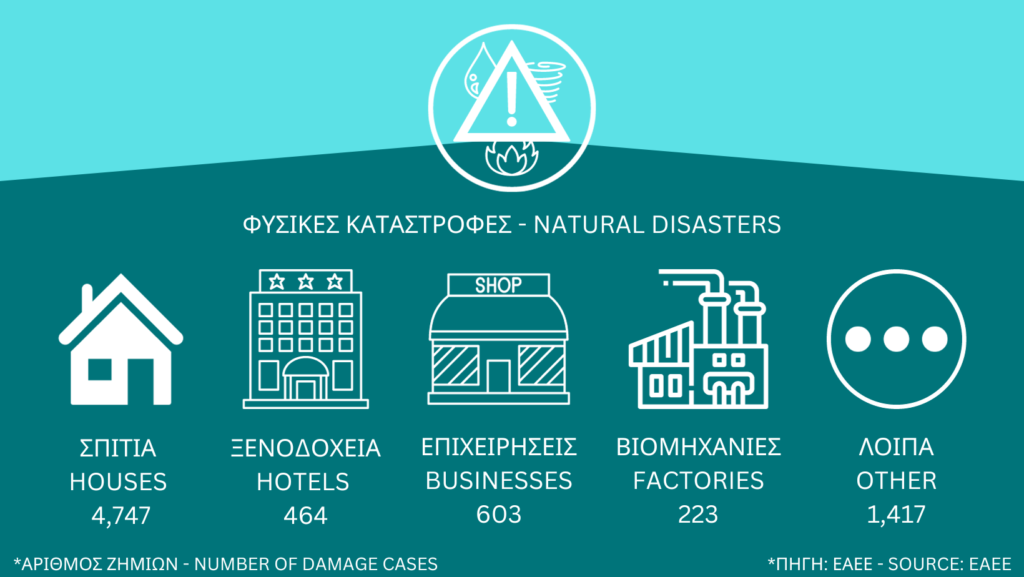

NATURAL DISASTERS

In recent decades and especially in recent years in Greece we have experienced several extreme natural phenomena, which led to great economic losses. Homes, businesses, crops and livestock farms were destroyed by floods, fires and earthquakes. Uninsured properties remained at the mercy of natural disasters. The properties that were insured were compensated, the buildings were rebuilt and the businesses were up and running again.

An example is Crete and the prefecture of Lasithi. From the extreme weather events in Crete on October 15th 2022, 135 damages were declared with a compensatory value of € 4,965,857. Of the 135 damages, 70 were declared in the prefecture of Lasithi with a compensatory value of € 2,450,913.

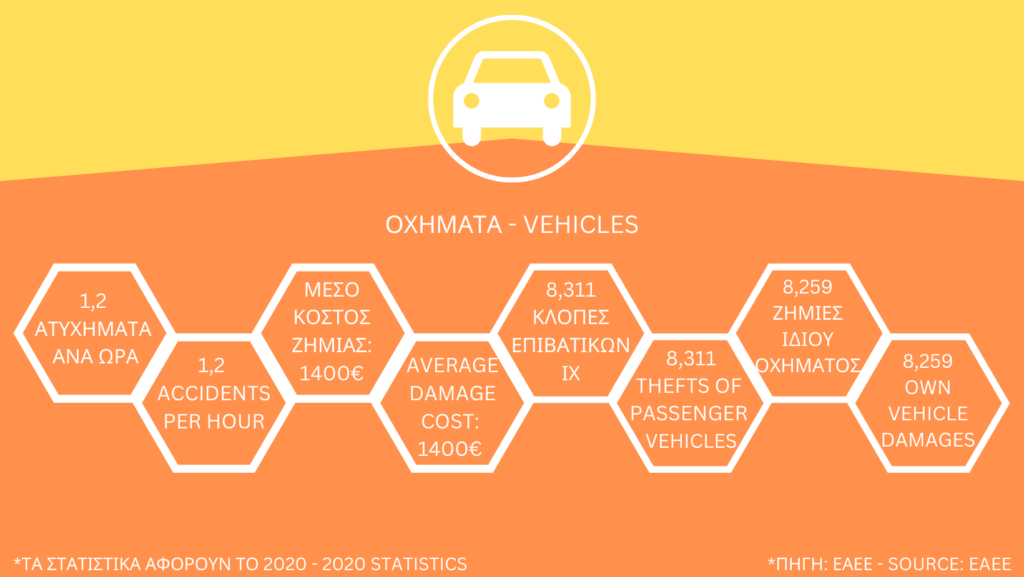

VEHICLES

According to the legislation, every car or motorcycle, as well as any other vehicle on the streets, must be insured. Otherwise, it cannot drive on a public road and the owner must have submitted the license plates, which is also done electronically on the myCAR platform of the Independent Authority for Public Revenue.

Although insurance is mandatory, many vehicle owners turn a blind eye, resulting in fines and criminal penalties that can sometimes be too high. In the latter case in particular, imprisonment of two months to one year is also foreseen.

In addition, a good car insurance program offers:

- Car protection

- Medical treatment in case of an accident

- Facilitation, as the insurance company’s lawyers undertake the post-accident procedures

- Protection from those who do not have their own security

- Roadside assistance

- Compensation, not only in case of an accident. Compensation from weather conditions, theft, vandalism, fire, etc.

HEALTH

On the one hand, medical science and technology are evolving rapidly (with new treatments and sophisticated machines) and on the other hand there is the pandemic and modern stressful conditions that increase morbidity. As a result, people live longer and become more ill. From the point of view of the public health system, this means high costs that it can no longer afford on its own, so the role of private health insurance is very important.

- Public insurance covers healthcare only in public hospitals. Private health insurance, on the other hand, offers options: If you go to a public hospital, you will receive the hospitalization allowance, while if you go to a private hospital, all your expenses will be covered.

- An additional important provision of private insurance, especially for people living outside large urban centers, is health transport in case of an emergency by any means possible. Air transport (by specialised medical planes) is ensured only by private insurance.

- Finally, we should emphasize that in private insurance we are not alone. We always have with us the insurance consultant who with deep knowledge guides and advises us, proving his sincere and genuine interest in us at a difficult time.

LIFE

Life insurance is about the lives of those we leave behind when we are no longer there. It is the supreme act of love we do to those we love and depend on us financially, so that they do not miss anything, pay the bills, educate the children and continue life unhindered, as if we were there…

For any information and to discuss your insurance needs click here.

For more information on all types of insurance you can visit our home page, by clicking here, and naviagte the menu, and also visit our blog page, by clicking here, where you will find information and insurance news.

You can find all the statistics of the article on the EAEE website.