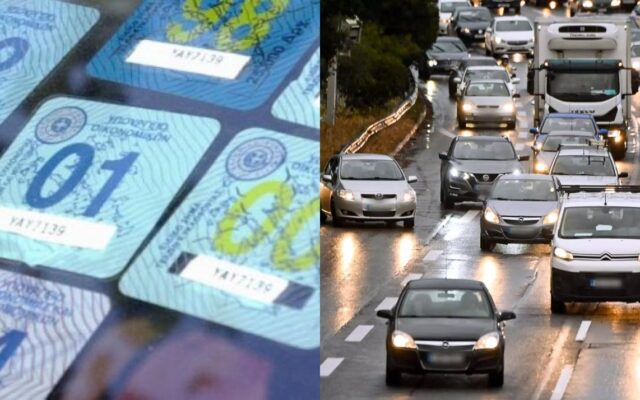

The government has announced two new measures concerning insurance and payment of Road Tax for all vehicles, with immediate effect.

- Compulsory insurance against natural disasters for all vehicles

As stated in article 26 of Law 5162/2024, all vehicles insured in Greece must be insured against natural disasters from December 1, 2025. Specifically in paragraphs 1 and 3 it states:

- The owner or user of a vehicle, stationed in Greece, in addition to the insurance obligations, according to the above presidential decree, is obliged to cover his vehicle with insurance against the risks of forest fire and flood, based on the current commercial value of the vehicle. The insurance obligation exists continuously from the granting of the license and registration plates, without depending on the actual movement or operation of the vehicle.

- Those obliged to insure hereunder are excluded from any state aid grant for the vehicles that have not been insured in accordance with par. 1.”

- New payment procedure for Road Tax

The new payment procedure, which is implemented this year for the first time, allows for strict timetables. If you delay road tax payment, there will be fines:

- Until January 31, 2025, the surcharge is 25%.

- Until the end of February 2025, the increase is 50%.

- From March 1, 2025, the amount of fees is doubled.

Payment methods remain flexible and include:

- Use of ATMs with the use of QR code from the payment notice.

- Electronic payment via e-banking with the 23-digit RF code.

- Payment to banks or ELTA with the notice.

We remind you that Road Tax charges are determined according to vehicle classification and CO2 emissions, making it more expensive for the most polluting vehicles.